Investing in turnkey real estate sounds like a dream, right? Who wouldn’t want a hassle-free, income-generating investment property that’s already renovated, rented, and professionally managed? No DIY fixes, no tenant hunting—just sit back and watch the rent roll in.

But here’s the thing—there are a lot of myths floating around about turnkey rentals. Some investors worry about sky-high costs, others think they’ll have zero control, and some question whether they’re even profitable. These misconceptions can scare people away from what might be a great investment opportunity.

Separating fact from fiction is crucial in understanding whether turnkey rentals are a good fit for your investment strategy. So, let’s clear the air. In this article, we’re busting the biggest myths about turnkey rentals. Let’s dive in.

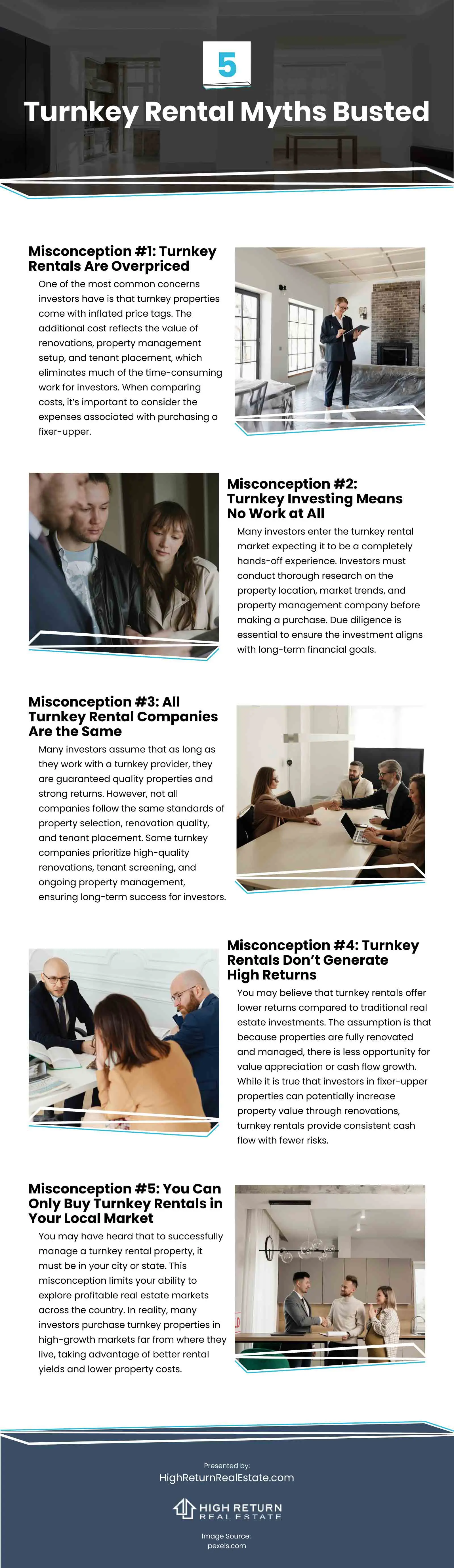

Misconception #1: Turnkey Rentals Are Overpriced

One of the most common concerns investors have is that turnkey properties come with inflated price tags. Many assume that because these properties are already renovated and rented out, they are significantly more expensive than traditional real estate investments. While it is true that turnkey properties often cost more upfront than distressed or fixer-upper homes, this does not mean they are overpriced.

The additional cost reflects the value of renovations, property management setup, and tenant placement, which eliminates much of the time-consuming work for investors. When comparing costs, it’s important to consider the expenses associated with purchasing a fixer-upper. Rehabbing a property requires significant time, money, and expertise, and many new investors underestimate the hidden costs that arise during renovations.

Additionally, turnkey rental companies leverage economies of scale by purchasing multiple properties in bulk, securing contractor discounts, and streamlining operations. This allows them to offer competitive pricing while still maintaining profitability. Instead of looking solely at the purchase price, investors should evaluate cash flow potential, long-term appreciation, and maintenance savings before assuming a turnkey rental is too expensive.

Misconception #2: Turnkey Investing Means No Work at All

Many investors enter the turnkey rental market expecting it to be a completely hands-off experience. While it is true that turnkey properties significantly reduce the day-to-day responsibilities of landlords, investors still need to be actively involved in making smart financial decisions.

Choosing a turnkey rental property is not as simple as buying a house and watching the income roll in. Investors must conduct thorough research on the property location, market trends, and property management company before making a purchase. Due diligence is essential to ensure the investment aligns with long-term financial goals.

Even after purchasing a turnkey property, investors should maintain oversight by reviewing monthly financial reports, tracking rental income, and staying informed about the property’s condition. A good turnkey provider will handle tenant relations, repairs, and general management, but it is still the investor’s responsibility to monitor performance and address issues as they arise.

While turnkey investing offers a more passive experience compared to traditional rentals, it is not 100% hands-off. Successful investors understand that even passive income requires some level of engagement to maximize returns.

Misconception #3: All Turnkey Rental Companies Are the Same

Another widespread myth is that all turnkey rental property companies operate the same way. Many investors assume that as long as they work with a turnkey provider, they are guaranteed quality properties and strong returns. However, not all companies follow the same standards of property selection, renovation quality, and tenant placement.

Some turnkey companies prioritize high-quality renovations, tenant screening, and ongoing property management, ensuring long-term success for investors. Others, however, may cut corners on property upgrades, place unreliable tenants, or charge excessive fees that reduce profitability.

To find the best turnkey rental property companies, you should thoroughly vet potential providers:

- Research their track record and look for investor reviews, testimonials, and references from past clients.

- Request financial projections and rental performance data for properties they offer.

- Understand their property management services, including how they handle vacancies, maintenance, and tenant relations.

- Ask about fees and expenses to avoid hidden costs that could eat into profits.

A reputable turnkey company will be transparent about its processes, provide detailed property reports, and offer ongoing support to ensure your investment can achieve your financial goals.

Misconception #4: Turnkey Rentals Don’t Generate High Returns

You may believe that turnkey rentals offer lower returns compared to traditional real estate investments. The assumption is that because properties are fully renovated and managed, there is less opportunity for value appreciation or cash flow growth. While it is true that investors in fixer-upper properties can potentially increase property value through renovations, turnkey rentals provide consistent cash flow with fewer risks.

Since turnkey properties are already generating rental income from the day of purchase, you can immediately start seeing returns without waiting for renovations to be completed or tenants to move in. This can be particularly advantageous in markets with strong rental demand and rising property values.

Additionally, turnkey rentals in the right locations can appreciate over time. Cities with population growth, job expansion, and strong rental demand often see property values increase, providing long-term financial benefits beyond just monthly rental income. If you are focused on passive income and steady returns, you will often find that turnkey properties are a reliable way to grow wealth without the volatility of riskier investments.

Misconception #5: You Can Only Buy Turnkey Rentals in Your Local Market

You may have heard that to successfully manage a turnkey rental property, it must be in your city or state. This misconception limits your ability to explore profitable real estate markets across the country. In reality, many investors purchase turnkey properties in high-growth markets far from where they live, taking advantage of better rental yields and lower property costs.

The key to successful remote real estate investing is partnering with a trustworthy turnkey provider that handles all aspects of property management, tenant placement, and maintenance. With modern technology, you can track rental performance, communicate with management teams, and make informed decisions remotely.

Buying in a diverse range of real estate markets allows you to spread risk, maximize returns, and take advantage of emerging rental hotspots that may not be available in your local area.

Final Thoughts

Turnkey rentals can be a great way to build passive income with minimal effort. However, misconceptions about costs, control, and profitability often make investors hesitant. The reality is, when approached strategically, these properties can offer steady cash flow and long-term value.

The keys to success are doing your research, choosing a reputable turnkey provider, and staying involved enough to make informed decisions. With the right approach, turnkey rentals can be a reliable and low-maintenance way to grow your investment portfolio. Understanding the risks and rewards will help you determine if this strategy aligns with your financial goals.