Have you noticed the real estate investing tides turning? The spotlight is shifting from towering urban apartment buildings to more relaxed, suburban multifamily investment properties. High-rise complexes in the heart of downtown used to be the go-to for city dwellers and investors alike. However, smaller, more approachable options in the suburbs are creating a new level of competition.

This isn’t some overnight trend. It’s been building for a while, and it’s picking up steam. If you’re an investor (or thinking about becoming one), it’s time to tune in and figure out what’s driving this shift, and how you can ride the wave.

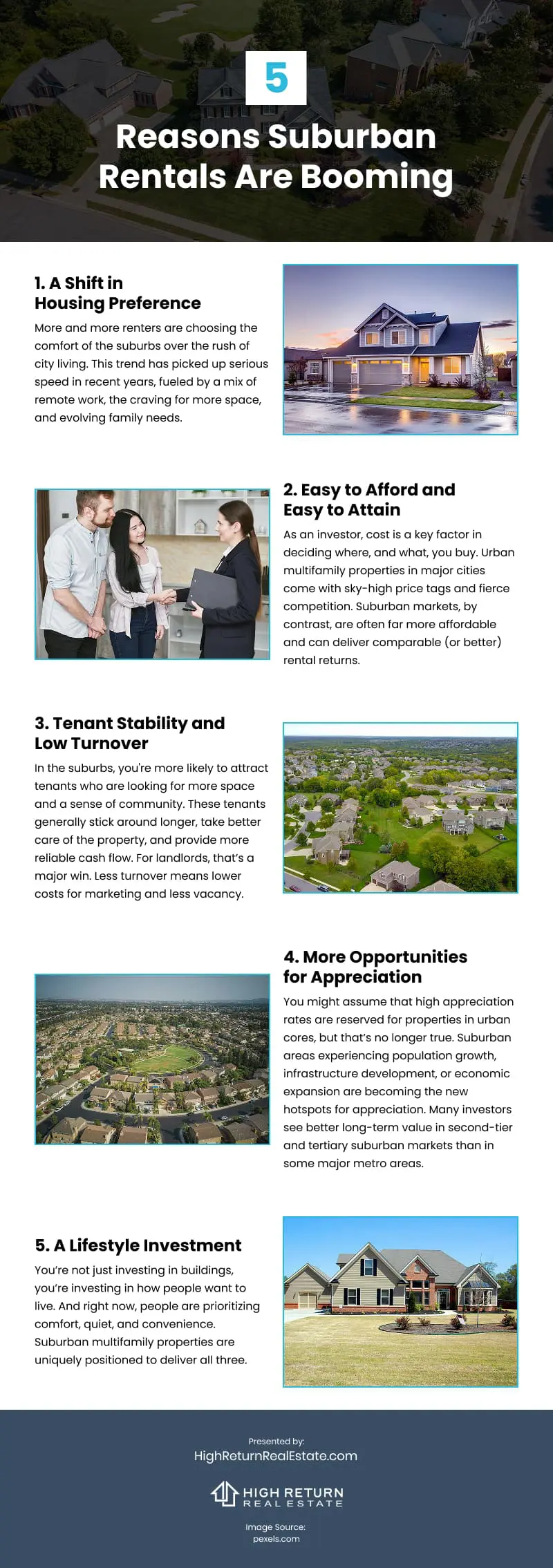

Why the buzz around suburban residential investment properties? Think affordability, growing demand, lifestyle changes, and strong long-term returns. Whether you're just getting started or looking to branch out, understanding this shift can open up smart, strategic opportunities that fit your investment goals.

A Shift in Housing Preference

More and more renters are choosing the comfort of the suburbs over the rush of city living. This trend has picked up serious speed in recent years, fueled by a mix of remote work, the craving for more space, and evolving family needs. When your office is your living room, proximity to downtown becomes a lot less important. That cozy two-bedroom apartment suddenly feels tight, especially if you're sharing it with a partner, kids, pets, or all three.

Suburban living offers a compelling alternative: more space for less money. And when it comes to multifamily properties, tenants get the perks of a built-in community without the hefty price tag of a single-family home. For renters who aren’t ready to buy, or simply prefer flexibility, suburban multifamily units hit the sweet spot.

As an investor, that’s your opportunity. These properties have momentum and staying power, making them a smart play in a shifting rental landscape.

Easy to Afford and Easy to Attain

As an investor, cost is a key factor in deciding where, and what, you buy. Urban multifamily properties in major cities come with sky-high price tags and fierce competition. Suburban markets, by contrast, are often far more affordable and can deliver comparable (or better) rental returns.

In many cases, your money stretches a lot further in the suburbs. For the price of a duplex in New York or San Francisco, you could pick up a four-unit building in a strong suburban market. Not only are acquisition costs lower, but so are property taxes and regulatory burdens. All adds up to a better shot at strong cash flow right out of the gate, especially if you target areas with solid, consistent rental demand.

Lower entry costs also make it easier to scale. Instead of locking up your entire budget in one high-stakes property, you can diversify across multiple suburban assets. You reduce risk while expanding your portfolio and income potential.

Tenant Stability and Low Turnover

Another reason investors are drawn to suburban multifamily properties is the stable, high-quality tenant base. In urban markets, renters are often younger professionals who tend to move frequently, driven by job changes, lifestyle shifts, or rising rents.

In the suburbs, you're more likely to attract tenants who are looking for more space and a sense of community. These tenants generally stick around longer, take better care of the property, and provide more reliable cash flow. For landlords, that’s a major win. Less turnover means lower costs for marketing and less vacancy.

Think about a triplex in a quiet neighborhood with good schools and nearby parks. You’re not attracting someone chasing the nightlife, you’re drawing in tenants who want to settle in and stay. That kind of long-term mindset leads to a more predictable rental experience.

More Opportunities for Appreciation

You might assume that high appreciation rates are reserved for properties in urban cores, but that’s no longer true. Suburban areas experiencing population growth, infrastructure development, or economic expansion are becoming the new hotspots for appreciation. Many investors see better long-term value in second-tier and tertiary suburban markets than in some major metro areas.

When evaluating markets, don’t stop at population growth. Dig deeper into indicators like school quality, job creation, and the number of new construction permits. These are often early signs that a suburban area is on the upswing, giving you a valuable window to invest before prices take off.

Take a suburban area that’s adding new transit lines, shopping centers, or business developments. Investing there can position you to ride the wave of rising property values. As more people move in and money flows into the local economy, demand for housing increases, driving up both rents and property prices. You don’t need a massive boom to see solid returns. Steady, modest appreciation over time can significantly boost your return on investment.

A Lifestyle Investment

You’re not just investing in buildings, you’re investing in how people want to live. And right now, people are prioritizing comfort, quiet, and convenience. Suburban multifamily properties are uniquely positioned to deliver all three.

If your focus has been solely on urban properties, now might be the perfect time to rethink your strategy. By tapping into the nationwide lifestyle shift, you can realign your portfolio with emerging demand—and stay one step ahead of the market.

As you grow your portfolio, think about how these trends fit with your long-term financial goals. Diversifying into suburban multifamily assets doesn’t just reduce your exposure to volatile urban markets. It can also provide steady, reliable returns for you.

With shifting renter preferences, stronger tenant stability, lower barriers to entry, and promising appreciation potential, these properties check all the right boxes. So if you’re ready to future-proof your portfolio and tap into where the market is headed. It might be time to look beyond the skyline and start thinking about suburbia. The opportunities are out there.

Video

Infographic

Suburban multifamily investment properties are growing in popularity as both renters and investors move away from congested urban areas. Discover five key reasons why suburban rentals are on the rise.