Grow Your Real Estate Portfolio

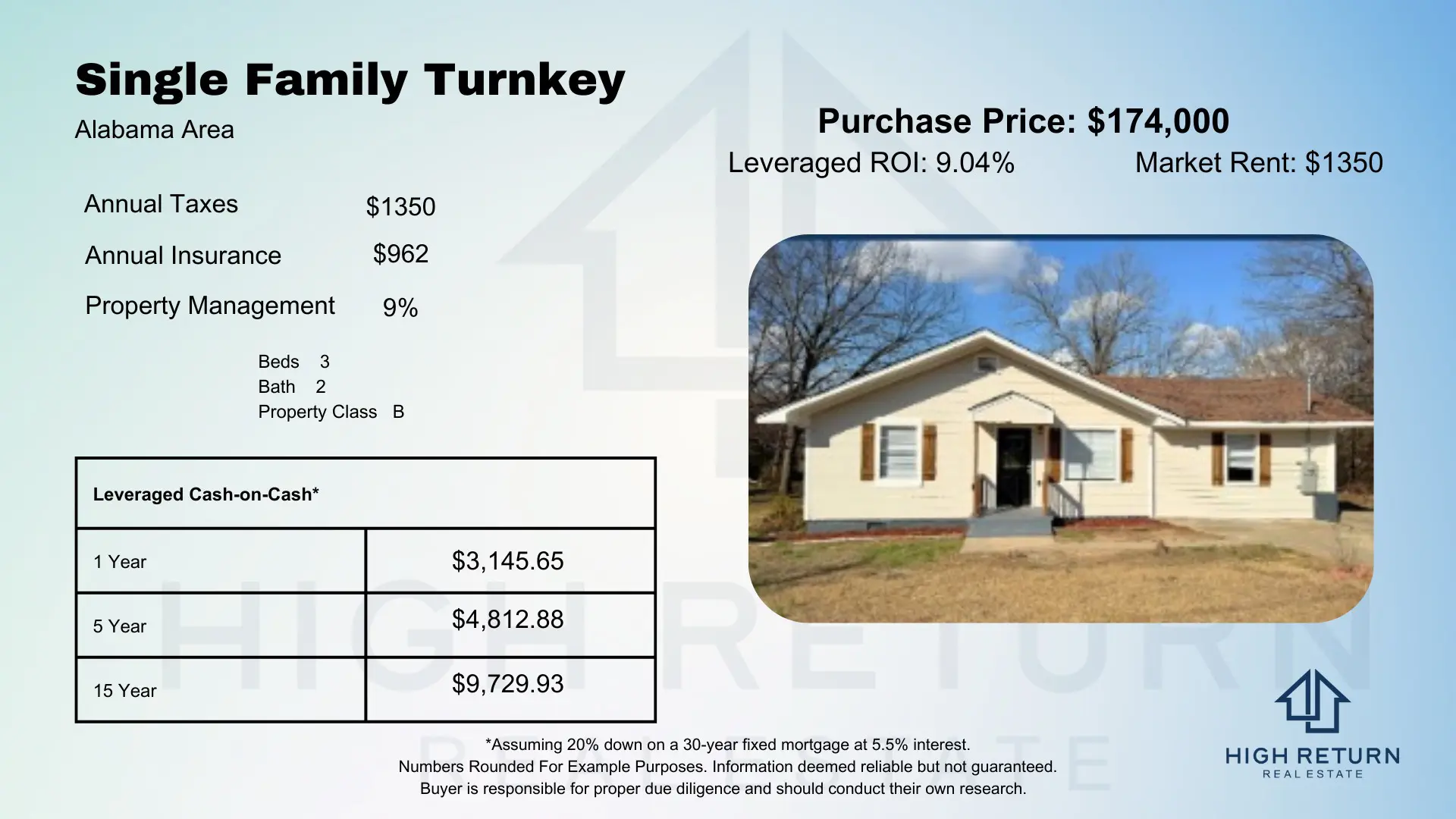

Single Family Turnkey

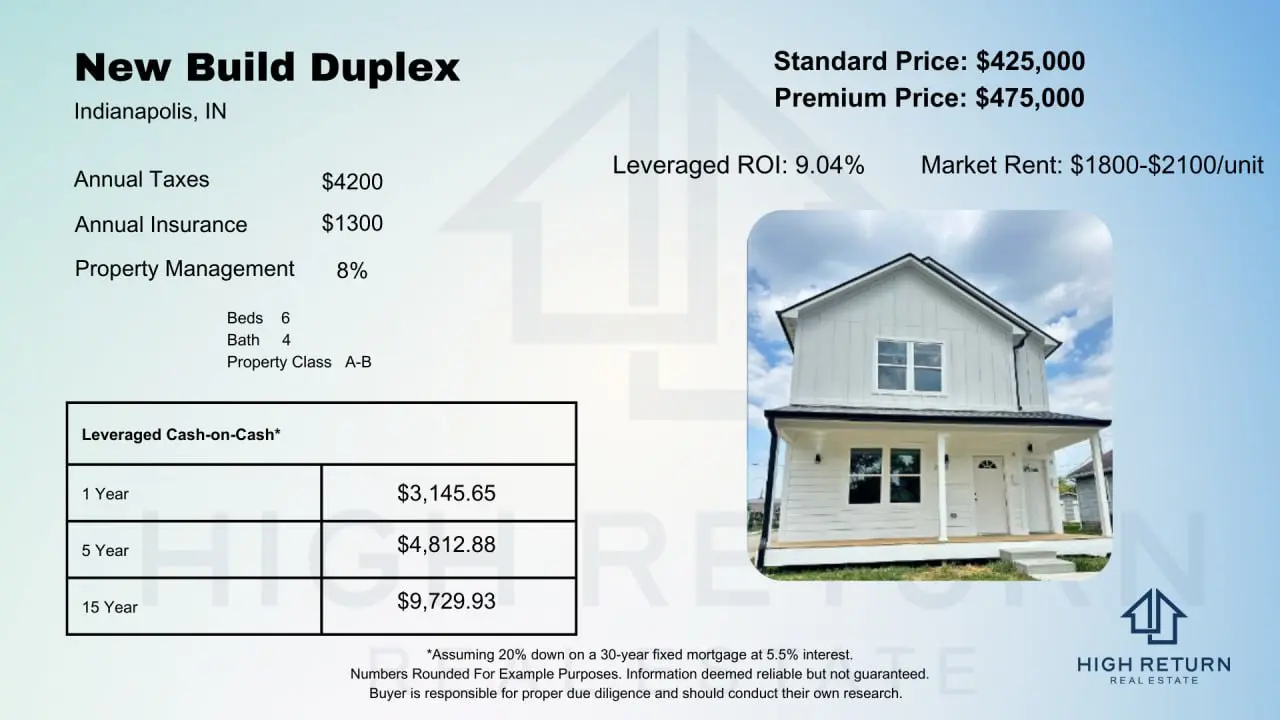

New Build Multi-Family

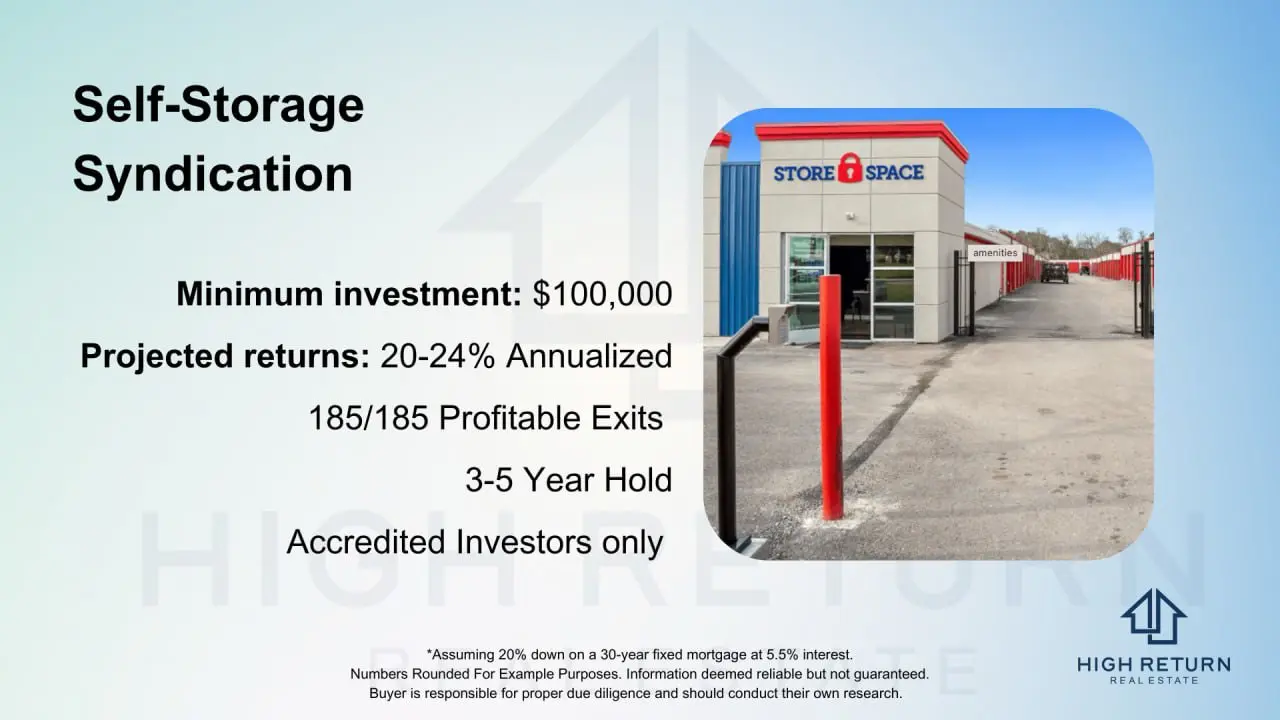

Self-Storage Syndication

Grow Your Real Estate Portfolio Through Turnkey Real Estate Investment Properties

Building a thriving real estate portfolio is one of the most effective ways to secure financial freedom and create a lasting legacy. With turnkey properties, investors can expand their portfolios efficiently while minimizing time commitments and the complexities often associated with traditional real estate investing. At High Return Real Estate, we help investors leverage opportunities in new construction rental homes, multi-family investment properties like duplexes and quadplexes, and more to maximize their returns with less stress.

What Are Turnkey Properties?

A turnkey property is a fully renovated, move-in-ready home designed to generate income from day one. These properties are typically located in high-demand markets and come equipped with professional property management, ensuring a seamless investment experience for buyers. Whether you’re purchasing a single-family home or buying a multi-unit rental property, turnkey properties allow you to focus on growing your wealth while professionals handle the day-to-day operations.

Key Features of Turnkey Properties:

- Fully Renovated: Upgraded with modern amenities to attract quality, long-term tenants, and reduce maintenance costs.

- Tenant-Ready: Pre-screened tenants ensure immediate cash flow.

- Professionally Managed: All aspects of property management, from rent collection to maintenance, are handled for you.

- Strategically Located: Situated in high-growth areas with strong rental demand.

Turnkey investing eliminates much of the guesswork, making it an ideal option for both new and experienced investors.

Why Invest in New Construction Investment Properties?

New construction rental homes offer unparalleled benefits for investors looking to grow their portfolios. Unlike older properties, these homes are built with modern standards, ensuring energy efficiency, lower maintenance costs, and greater tenant appeal and retention.

Benefits of New Construction Rental Homes:

1. High Tenant Demand

Tenants are often drawn to the modern features and pristine condition of newly built homes. With brand-new appliances, open layouts, and energy-efficient systems, these properties stand out in competitive rental markets.

2. Minimal Maintenance Costs

New construction homes require little to no immediate repairs, saving you time and money. Builders provide warranties on their work, offering additional peace of mind for investors.

3. Energy Efficiency

Modern building materials and technologies make new homes significantly more energy-efficient than older properties. Lower utility bills attract tenants and increase the long-term value of your investment.

4. Higher Resale Value

As new neighborhoods develop, the surrounding infrastructure, such as schools, shopping centers, and parks, often increases property values. Investing early in a new construction rental home positions you to benefit from long-term appreciation.

By including new construction properties in your portfolio, you’re not only investing in immediate cash flow but also in assets designed to grow in value over time.

Exploring New Multi-Family Investment Properties

For investors seeking to scale their portfolios quickly, new multi-family investment properties are an excellent option. Multi-family properties, such as duplexes, quadplexes, and apartment complexes, allow you to generate income from multiple units within a single investment.

Advantages of New Multi-Family Investment Properties:

1. Economies of Scale

Managing multiple units in one location is often more efficient than managing several single-family homes spread across different areas. This reduces operational costs and simplifies property management.

2. Higher Cash Flow Potential

Multi-family properties typically generate more rental income per property compared to single-family homes, making them a lucrative choice for investors focused on cash flow.

3. Diverse Tenant Base

With multiple units, you’re less reliant on a single tenant for income. Even if one unit is vacant, the other units can continue generating revenue.

4. Appreciation and Equity Growth

New multi-family properties in high-demand markets often appreciate in value quickly. Additionally, as tenants pay down the mortgage, you build equity faster than with single-unit properties.

5. Financing Benefits

Lenders often view multi-family properties as lower risk because they offer multiple streams of income. This can make financing easier and more favorable for investors.

Multi-family properties are an excellent way to diversify your portfolio, increase cash flow, and maximize long-term returns. Whether you’re new to real estate or an experienced investor, these properties provide a scalable pathway to success.

What to Know About Buying Multi-Unit Rental Properties

When it comes to buying multi-unit rental properties, preparation is key. These properties offer incredible opportunities, but it’s important to approach the investment strategically to ensure success.

Steps to Buying Multi-Unit Rental Properties:

1. Define Your Investment Goals

Are you looking for immediate cash flow, long-term appreciation, or a mix of both? Understanding your goals will help you select the right property and market.

2. Research the Market

Location is everything in real estate. Look for markets with strong rental demand, growing populations, and stable economies. High Return Real Estate focuses on identifying these key growth areas for our clients.

3. Evaluate the Property’s Potential

Analyze critical metrics such as:

- Cash Flow: Income minus expenses.

- Cap Rate: A measure of profitability based on net operating income and property value.

- Occupancy Rates: Higher occupancy rates indicate strong demand.

4. Secure Financing

Financing multi-unit properties differs from single-family homes. Be prepared to provide detailed financial documents and explore options such as conventional loans, commercial loans, or portfolio loans.

5. Work with Experts

Partnering with a company like High Return Real Estate simplifies the process. From property selection to ongoing management, our team ensures your investment is set up for success.

Turnkey Real Estate Investing: Your Path to Portfolio Growth

Whether you’re investing in new construction rental homes or multi-family investment properties, turnkey real estate is a powerful strategy for building wealth. By focusing on high-demand markets, professionally managed properties, and scalable investments, you can grow your portfolio with confidence and ease.

Benefits of Partnering with High Return Real Estate:

- Expert Guidance: Our experienced team helps you identify and secure high-performing properties.

- Hassle-Free Management: Professional property management ensures your investments are well-maintained and profitable.

- Customizable Strategies: We tailor our approach to align with your financial goals and risk tolerance.

- Proven Results: Our track record speaks for itself, with countless investors achieving financial freedom through our turnkey solutions.

Expand Your Investment Portfolio with Less Hassle

There's not just one way to add real estate to your investment portfolio. Successful real estate investors include those that turn fixers into profitable recurring income generating properties and those that buy shares of real estate investment trusts (REITs). However, if you, like many investors, want to buy real property but don't want to spend your time vetting renters, renovating properties, or calling handymen at all hours of the day and night, it's time to consider the benefits of buying turnkey investment properties.

Turnkey investing makes real estate accessible even for people who live states or even countries away. These properties are already rehabbed, tenanted, and professionally managed, allowing you to step into immediate cash flow. It’s a strategy that pairs perfectly with long-term wealth-building goals, particularly if you're aiming to generate recurring income without getting bogged down in the day-to-day complexities of managing multiple properties.

This page supplements the turnkey property insights you’ll find on our main page, helping you understand the broader opportunities available and how they fit into your larger investment strategy.

Why Indianapolis Is Ideal for Turnkey Property Investing

Indianapolis stands out as one of the most promising real estate investing markets in the country. With a balance of affordability, strong rental demand, and long-term growth potential, this Midwest city offers fertile ground for investors seeking consistent, passive income without the headaches of traditional property management.

Indianapolis combines favorable housing prices with strong rental demand, making it an excellent choice for anyone looking into turnkey investment properties for sale. The city benefits from a stable and diversified economy, with industries ranging from logistics and technology to healthcare and education. These employment sectors contribute to long-term population stability, an important factor for minimizing vacancy risk.

Furthermore, the Indianapolis market is well-suited for turnkey strategies.

Affordable Entry Prices

Compared to major coastal markets, Indianapolis offers real estate investors an attractive entry point with significantly lower property prices. These affordable values, combined with strong rent-to-value ratios, allow investors to generate positive cash flow with less upfront capital.

High Rental Demand

Cities like Indianapolis are seeing steady population growth driven by young professionals, students, and working-class families that typically prefer renting over homeownership. With a lower-than-average cost of living and a strong job market, the demand for quality rental housing remains consistently high. This creates a reliable tenant pool and reduces vacancy rates, especially in neighborhoods with updated, move-in-ready properties.

Landlord-Friendly Policies

Indiana is considered one of the most landlord-friendly states due to its efficient legal system that allows for relatively quick evictions in cases of non-payment or lease violations. The state imposes fewer restrictions on security deposit limits and lease terms, giving landlords more flexibility in managing their properties and mitigating risk.

Turnkey Property Types and What They Offer

Within the Indianapolis real estate market, there are a variety of turnkey investment properties. Whether you’re looking for a starter single-family rental or a larger multi-family property, this market accommodates a wide spectrum of investor profiles.

Single-Family Homes

Single-family properties are ideal for newer investors looking for a stable first asset because they are often easier to finance and manage. Turnkey homes for sale make this path even more accessible by offering fully renovated, ready-to-rent properties that minimize the need for immediate repairs or upgrades. These homes tend to attract reliable, long-term tenants like families or working professionals, providing consistent rental income.

Multi-Family Properties

Turnkey multi-family properties for sale generate income from several units within one location, giving investors a reliable way to offset vacancies or late payments from any single tenant. This built-in diversification helps create more predictable cash flow and financial resilience. Additionally, managing multiple units under one roof streamlines operations, making these properties both efficient and scalable for long-term growth.

New Construction

New construction properties come with brand-new systems, including plumbing, electrical, and HVAC, which means fewer unexpected repairs and lower maintenance costs at the outset. Their contemporary designs, energy efficiency, and modern amenities appeal to quality tenants who are willing to pay a premium for comfort and convenience. This combination of reduced upkeep and strong rental demand makes new builds a smart choice for investors focused on cash flow positive turnkey investment properties that offer long-term stability.

Why Investors Are Choosing High Return Real Estate

At High Return Real Estate, we don’t just offer properties; we offer outcomes. Our proven process ensures that every turnkey property for sale we list has gone through rigorous vetting, full-scale renovation, and proper tenant placement. We also provide you with a complete team from property management to investor support, so your turnkey purchase becomes a hands-off, cash-flowing asset from day one.

Unlike other investment companies, we focus exclusively on turnkey property investing in high-yielding markets like Indianapolis, where returns are sustainable and long-term growth is achievable. Our clients don’t just buy properties to increase their monthly income; they build portfolios designed to weather market cycles and support generational wealth creation.

FAQ About Turnkey Real Estate Investing

1. Can I Invest in Multi-Family Properties Without Prior Experience?

Absolutely. Our turnkey solutions are designed to make real estate investing accessible to everyone, regardless of experience. We handle the complexities so you can focus on growing your wealth.

2. What Are the Best Markets for Turnkey Real Estate?

We focus on high-growth markets with strong rental demand and appreciating property values. These areas often include growing cities and suburban neighborhoods with robust economies and low vacancy rates.

3. How Do New Construction Homes Compare to Older Properties?

New construction homes offer lower maintenance costs, modern features, and greater energy efficiency, making them more appealing to tenants and reducing your long-term expenses. Older properties may require significant renovations, which can eat into your profits.

4. How Quickly Can I Start Earning Income?

With tenant-ready properties and professional management, you can start generating passive income immediately after closing on your investment.