What do Stephen Ross and Donald Bren have in common? Both were investors, both started with an initial investment of $10,000, and both grew their investments to be worth billions. How were they able to turn this small initial amount into billion-dollar portfolios? Real estate.

Real estate investing has become one of the most lucrative businesses in the country. According to the S&P 500, the average rate of return on investment properties is 10.6%. Unlike purchasing cryptocurrency or even stocks, investors accrue real, tangible assets when they buy residential investment properties. Once a productive management system has been established, real estate investors can sit back and enjoy the passive income generated from real estate ownership.

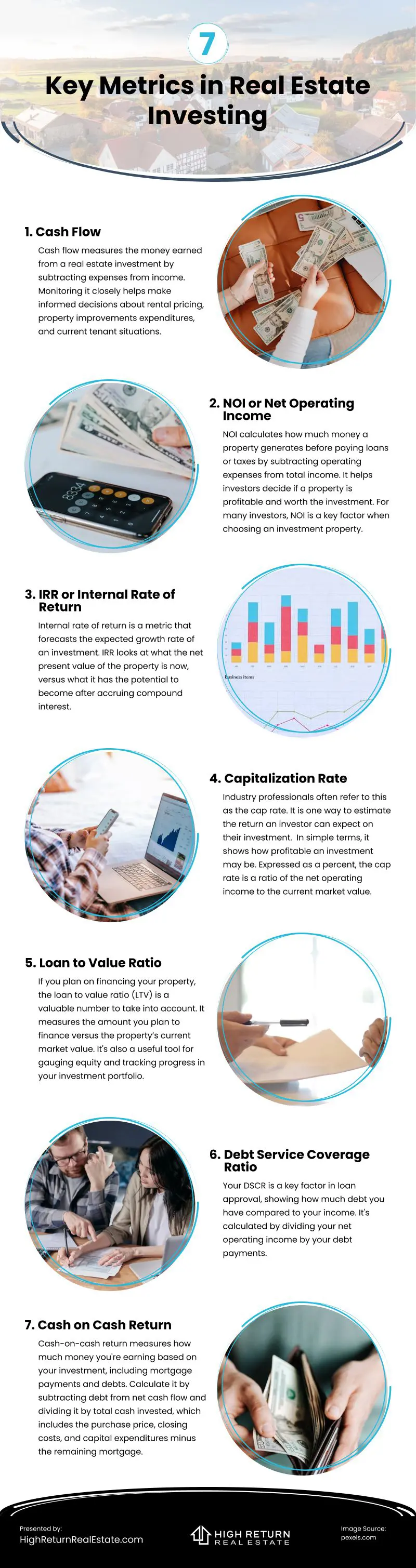

Not every property is a ticket to the top, though, and choosing which properties to invest in takes time and effort. It is more than simply looking at the purchase price and what you may be able to charge in rent. Wise investors take many factors into consideration before deciding a property is a good investment. Whether you are new to real estate or a seasoned investor, the following metrics are key factors to think about.

1. Cash Flow

It may seem like a basic concept, but the goal of investing in real estate is to make money. Cash flow is a measure of just how much money you are making on your real estate investment. You can calculate cash flow by subtracting your expenses from your income. For example, if you charge $3,000 a month in rent and your operating expenses for the month are $2,000, then you have a cash flow of $1,000 for that month.

When your income exceeds your expenses, you have a positive cash flow, and your investment is working for you. However, if the investment is costing you more than it’s bringing in, your cash flow is negative. This type of investment is a drain on your finances and may keep you from reaching your financial goals. Keep in mind that cash flow may be slow in the beginning, but it should increase over time.

Monitoring of your cash flow carefully can help you make informed decisions about rental pricing, property improvement expenditures, and current tenant situations. Adjustments can also improve your cash flow.

2. NOI or Net Operating Income

While your net operating income and your cash flow both help you understand how much income your property generates, each provides a unique perspective. Cash flow provides a snapshot of how much your property earns. Your NOI calculates how much money your investment property generates before paying loans or taxes. It is your total income minus your operating expenses.

Total income is more than just rent payments. It also includes the extras you may charge for service fees, parking, or laundry. It is the TOTAL money your investment brings in each month.

Operating expenses are payouts for things like: property maintenance, property taxes, property management, utilities, or legal fees. You do not take mortgage payments, interest, or other taxes into account when calculating your NOI.

Looking at an investment’s NOI helps potential investors determine whether or not a property will bring in enough money to be worth the investment. For many investors, NOI is the most important factor they consider when choosing an investment property.

3. IRR or Internal Rate of Return

Internal rate of return is a metric that forecasts the expected growth rate of an investment. IRR looks at what the net present value of the property is now, versus what it has the potential to become after accruing compound interest.

To calculate the IRR, set the net present value of the property to zero. Then factor in the cash flow you anticipate each year of ownership. These calculations can get complicated. Programs like the IRR function in Excel can help with calculations. When using this tool, it is important to recognize that it does not account for fluctuations in the rental market or unexpected expenses associated with property ownership.

4. Capitalization Rate

Industry professionals often refer to this as the cap rate. It is one way to estimate the return an investor can expect on their investment. In simple terms, it shows how profitable an investment may be. Expressed as a percent, the cap rate is a ratio of the net operating income to the current market value.

Investments with high cap rates are often riskier but offer a higher return on your investment. High cap rates may be more prevalent in smaller, less stable markets. Investments in more stable markets typically yield lower returns and lower cap rates.

5. Loan to Value Ratio

If you plan on financing your property, the loan to value ratio (LTV) is a valuable number to take into account. It measures the amount you plan to finance versus the property’s current market value. Your LTV is also a good way to gauge the equity you have accrued and track it in your investment portfolio.

6. Debt Service Coverage Ratio

Think of this as the number that decides if you get approved for a loan. Lenders look at this number, known also as your DSCR, to see how much debt you currently hold, compared to how much income you have. This number is generated by dividing your net operating income by your debt payments.

If your DSCR is high, a lender may deny your financing out of concern that monthly payments may not come through. If your DSCR is low, your lender is more likely to approve your financing application.

7. Cash on Cash Return

This metric will tell you how much money you are earning based on the amount you invested. Unlike your NOI, cash on cash returns include mortgage payments and other debts. To find this number, subtract your debt from your net cash flow, and divide it by the total cash in. Total cash is summed up as the purchase price of the building (plus closing costs), minus the remaining amount of the mortgage, plus capital expenditures.

Forecasting cash on cash returns will help in choosing the best investment for your circumstances, as well as the best way to finance it.

Informed Decisions

Real estate investing is an exciting way to build your portfolio. For those new to the game, it may feel overwhelming and risky. That’s why we recommend crunching the numbers and evaluating key metrics before taking the plunge. Understanding these metrics when considering an investment property will help you understand your risk and increase earning potential. The more you know about your real estate investment, the better prepared you will be to add lucrative real estate investments to your portfolio.

Video

Infographic

Not all properties ensure high returns, and choosing the right ones requires effort. Whether novice or experienced, investors should consider key metrics, as outlined in this infographic, before making investment decisions.