Over the last decade, the face of modern real estate investing has drastically changed. With today’s tech, easier financing options, and nationwide property management services, you’re no longer stuck investing only in your local market. You can tap into some of the best opportunities across the country—all without ever leaving home. But like any smart investment, success isn’t about luck; it’s about planning, research, and creating a solid strategy.

If you want to make the most of remote real estate investing, you’ve got to understand what sets it apart and how to tackle the challenges of not being physically there. From picking the right markets to building a reliable local team, every move you make matters even more when you’re handling investments from afar.

Understand Your Investment Goals Before You Start

Before jumping into any real estate deal, especially one that’s out of state, you need to define your goals. Are you looking for steady monthly cash flow, long-term appreciation, or a mix of both? Maybe you're trying to grow your real estate portfolio and hedge against local market instability. Whatever the case, your goals should guide every step of your remote investing journey.

When you're not close to the property, you can't afford to be vague. You need a clear picture of your desired return on investment, risk tolerance, and preferred property types. For example, if you're seeking consistent cash flow, you might target secondary markets with affordable housing and strong rental demand. If appreciation is your focus, you may consider emerging metro areas with population growth and economic development.

Choose the Right Market, Not Just the Cheapest One

It’s tempting to chase low property prices, especially when you're browsing homes in regions with drastically different costs from your own. But price alone doesn’t define a good investment. You have to evaluate the health of the local economy, job growth, population trends, and demand for rental housing. You also want to examine landlord-tenant laws and tax implications.

For example, if you live in a high-cost area like San Francisco, you might find that a city like Indianapolis offers better cap rates, landlord-friendly regulations, and more affordable entry points. But that doesn’t mean every neighborhood in Indianapolis is a good bet. You still need to look at crime rates, school districts, and property appreciation trends.

Start by identifying a few promising markets. Do a deep dive into each one. Talk to local agents, listen to real estate podcasts that cover market trends, and use online tools to analyze rental comps and vacancy rates. The more informed you are, the less likely you are to make a decision based on gut instinct alone.

Work With a Reliable Local Team You Can Trust

One of the most important parts of succeeding in remote real estate investing is having a solid team on the ground. Since you won’t be there to walk through the property or meet with tenants, you’ll have to rely on others to be your eyes and ears. That means you need people who are skilled, knowledgeable, communicative, and genuinely interested in your success.

At the very least, you’ll need a trustworthy real estate agent, a reputable property management company, and a reliable contractor or handyman. In some cases, you might also want to work with a local attorney or CPA familiar with real estate in that area. Don’t settle for the first professional you find, either. Ask for referrals, conduct interviews, and verify licenses or certifications.

A strong team doesn’t just help you maintain your property—they help you avoid costly mistakes. A good property manager, for instance, will screen tenants thoroughly, handle maintenance issues promptly, and keep you updated on how your property is performing. This peace of mind is essential when you're investing from a distance.

Use Turnkey Providers Carefully and Strategically

Turnkey real estate companies can be a great entry point if you're new to remote investing. These companies sell properties that are already renovated, tenanted, and managed by in-house teams. While this convenience is appealing, it's not without risk. You need to be careful when choosing who to work with, as not all turnkey providers operate with the same level of transparency or quality.

Make sure you vet the company thoroughly. Ask to speak with other investors who have purchased properties through them. Request tenant background reports and cash flow projections. A good turnkey provider will be happy to share this information with you and explain how they maintain properties after the sale.

If done right, buying from a turnkey provider can streamline the process and provide immediate cash flow. But don’t rely on their marketing alone. Use your judgment and do independent research to make sure the numbers and the location check out.

Embrace Technology to Stay Connected

You don’t have to live near your property to stay informed—you just need the right tech tools. Today, you can monitor property performance from a distance. Many property management companies offer online dashboards where you can view financial reports, lease agreements, and maintenance logs in real time.

Use platforms like Google Drive to store important documents, Zoom or Google Meet for face-to-face conversations with your team, and property management apps to track income and expenses. This way you’ll always know how your investment is doing—even if it’s thousands of miles away.

Start Small and Scale Smart

It can be tempting to buy multiple properties right away, especially when prices seem attractive. But when you’re investing remotely, it’s smarter to start small. Focus on acquiring a single investment property and learning the ropes before expanding your portfolio. This allows you to test your systems, evaluate your team, and get a sense of what works (and what doesn’t) from afar.

Once you’re confident, you can begin scaling in a way that aligns with your goals. Maybe you expand within the same market where you’ve already built a team, or perhaps you explore new cities with similar characteristics. Either way, your first investment will give you valuable insights that help guide your next move.

Keep in mind that remote investing is a long-term strategy. You’re not flipping homes or chasing quick wins—you’re building a portfolio that earns money for you and appreciates over time. By scaling smart, you minimize risk and give yourself room to grow sustainably.

Mistakes to Avoid in Remote Investing

Even experienced investors make mistakes when venturing into long-distance deals. Awareness of common pitfalls can help you avoid them. Here are a few you’ll want to steer clear of:

- Relying solely on online listings or marketing materials without seeing inspection reports or running financials.

- Skipping due diligence just because a property “looks good” on paper.

- Failing to build a relationship with your property manager and assuming they’ll handle everything perfectly.

Each of these missteps can lead to financial losses or long-term issues that are harder to fix from afar. Stay proactive and informed. It will protect your investment and build confidence in your ability to manage remotely.

Long-Distance Investing Works

You don’t have to live near your rental properties to crush it in real estate—you just need a smart game plan and the right systems in place. Remote investing lets you chase better returns in markets that fit your goals, not just your ZIP code.

By setting clear objectives, choosing the right markets, building a solid local team, and using technology to your advantage, you’re setting yourself up for success. Sure, remote investing has its challenges, but with the right mindset and preparation, it can be one of the most rewarding ways to grow your portfolio and build long-term wealth—no matter where you call home.

Video

Infographic

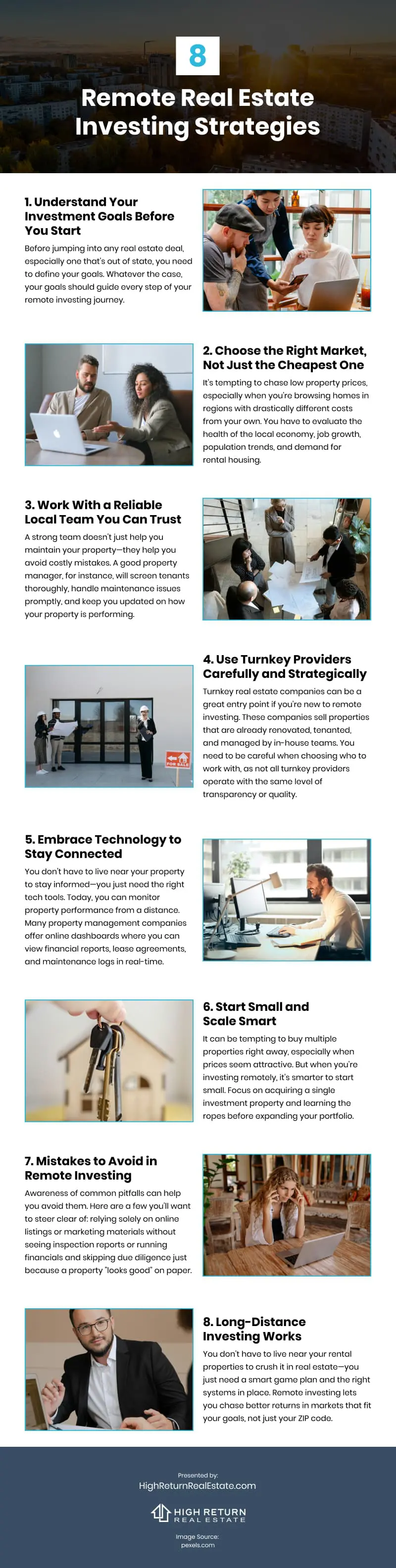

Remote real estate investing gives individuals access to high-performing markets from afar but also comes with unique challenges. Check out this infographic for effective strategies to navigate remote real estate investments.