Funding real estate investments requires a strategic approach to maximize opportunities and minimize financial risks. Like a gardener chooses the proper soil to plant his seeds, ensuring a safe and effective environment for his plants to grow, real estate investors must also be selective about which type of funding to pursue.

Making an educated decision about your lending options is the key to developing a beautiful garden of successful investments. There is a wide variety of funding options, each with its own advantages and disadvantages. Below, we will focus on six most common ways to fund your real estate investment.

1. Commercial Loans

Commercial loans work best for properties purchased for business purposes: retail establishments, restaurants, warehouses, apartment complexes, or mixed-use spaces. They do not provide funding for single-family housing or owner-occupied homes. These loans can have shorter terms, ranging from five to 20 years. Borrowers should also understand that commercial loans come with the possibility of a balloon payment at the end of the term, where a large lump sum is due.

- Advantages of commercial loans: Commercial loans have higher borrowing limits, allowing investors to purchase more expensive, large-scale properties. They also offer the possibility of more extended repayment periods, lowering the monthly bank payments and increasing cash flow.

- Disadvantages of commercial loans: Commercial loans can be challenging to qualify for. The process can be pretty lengthy. Lenders require extensive documentation of your financial history, your credit scores, and a strong business plan. Because commercial loans are a higher risk, lenders ask for a larger down payment, which can come with higher interest rates than other types of loans.

2. Conventional Bank Loan

A conventional bank loan is a common way to fund your real estate investment. Conventional loans obtained through a bank, credit union, or mortgage company have guidelines set by Fannie May or Freddie Mac (government-sponsored enterprises that keep mortgages affordable and stable). Lenders often require a 25% down payment on loans intended for investment properties. Lenders also look at your credit score and credit history to determine the interest rate you qualify for. They look at your debt-to-income ratio and other assets to ensure you can afford a new loan.

- Advantages of conventional loans: Conventional loans come with lower interest rates, making them more affordable over extended periods. Fixed interest rate options make payments stable and predictable. They also offer a variety of repayment timeframes, giving you the option of a longer repayment period and lower monthly payments.

- Disadvantages of conventional loans: Conventional loans have stricter qualification guidelines. They require higher credit scores and lower debt-to-income ratios. The 25% down payment requirement can also hinder your ability to qualify. These types of loans do not consider future rent payments when looking at your income. They may even expect six months of cash set aside to cover the mortgage payment without rental income. For many investors, these strict guidelines make it difficult to qualify.

3. Hard Money Loan

Hard money loans are usually obtained through private lenders or investment groups. They work well for investment properties with a quick turnaround. Developers or those planning to flip a house for profit may secure this type of loan, knowing that it will be paid off quickly. Rather than assessing the borrower's qualifications, hard money loans consider the potential value of the property once repairs and enhancements are made.

- Advantages of hard money loans: These types of loans are easier to qualify for since income and credit history are not taken into account. Investors seeking these loans do not have to jump through the hoops of a regular lending establishment. Loans can happen quickly, allowing investors to seize an opportunity when it arises.

- Disadvantages of hard money loans: Hard money loans typically have higher origination fees and closing costs. They also have higher interest rates, starting at 10% and up. The short-term loan can also be a disadvantage if unforeseen problems arise with the property, and reselling takes longer than anticipated.

4. Private Loan

Private loans come from your inner circle; friends and family who are interested in real estate for investment. The terms of the loan depend on the person lending to you and can vary from generous to strict. They are secured by a legal document stating the terms of the loan and if defaulted upon, the lender has the right to foreclose on the property.

- Advantages of private loans: Due to their nature, private loans can happen quickly. Like hard money loans, private loans do not have the same requirements as bank loans. They can be as simple as signing a promissory note and moving the money into your account. With a private loan, you can avoid origination fees and closing costs.

- Disadvantages of private loans: Money can damage relationships. It is wise to approach private loans with caution. There is no regulation or oversight when it comes to private loans, and emotions can get in the way of the agreed-upon terms. Be careful who you choose to borrow money from.

5. Home Equity Loan

If you already own a home, you can take out a loan against its equity. This is called a Home Equity Loan of Credit or a HELOC. You can borrow up to 80% of the home's value, giving you the ability to make a down payment or even a full payment on a new property.

- Advantages of a home equity loan: HELOCs are flexible loans. You can apply for any amount, up to 90% of the property value. You take out what you need and can spend that money on any purchase. There are no qualifiers on what the money has to go towards. HELOCs come with low interest rates, and making timely payments improves your credit score.

- Disadvantages of a home equity loan: Taking out a loan on the equity of your primary residence puts your home at risk. If you default on this type of loan, the bank can foreclose on your property, leaving you nowhere to live. HELOCs are also limited to the amount of equity you have acquired, so the loan is small if there is little equity.

6. All In One Loan

This past year, our company has sold 22 new build multi-family rental properties to investors, and every single investor has decided to go with the little known “All in One” loan. This speaks to the advantages this obscure product offers, as these are all experienced real estate investors.

It’s likely you haven’t heard of this product, as I’ve been in the real estate space for eight years and just learned of it this past year. This is a very exciting product that can save you a substantial amount of interest and give you a lot more flexibility in how you manage the cash flow and access to your funds.

An All in One Loan works very similar to a HELOC, but unlike a traditional HELOC, it’s not a secondary loan on the property. This product gives you a line of credit for the entire loan, so if you decide to pay it down early, you still have access to that capital should you need it for literally anything.

What holds most investors back from paying down their loan principal early is that they know how hard it is to get that money back out should they need it. It’s darn near impossible to get it back out, unless you sell the property or refinance the loan.

- Advantages of an All in One: With an All in One, you can pay down the principle, immediately reduce your interest payment, and pull it back out the very next day. It also comes with an attached checking account, so if you place your savings or emergency funds in the checking account, you immediately reduce the principle of the loan!

- Disadvantages of an All in One: The downsides to the All in One is that you can only get one or two of them, so make sure to use this for a bigger price point purchase. Also, the interest rate is typically a point higher than a conventional loan, so if you don’t utilize the attached checking account and don’t utilize cash flow from rents to pay down the loan, you may end up paying a bit more in interest.

There are many other creative options for funding your real estate investments. The five listed above are a few of the most traditional ways, but keep looking if you need something else. There are other avenues. Whatever lending source you choose, make it makes sense for your individual needs. The right financing will allow you to watch that investment garden grow, moving you towards your hopes of financial freedom through real estate.

Video

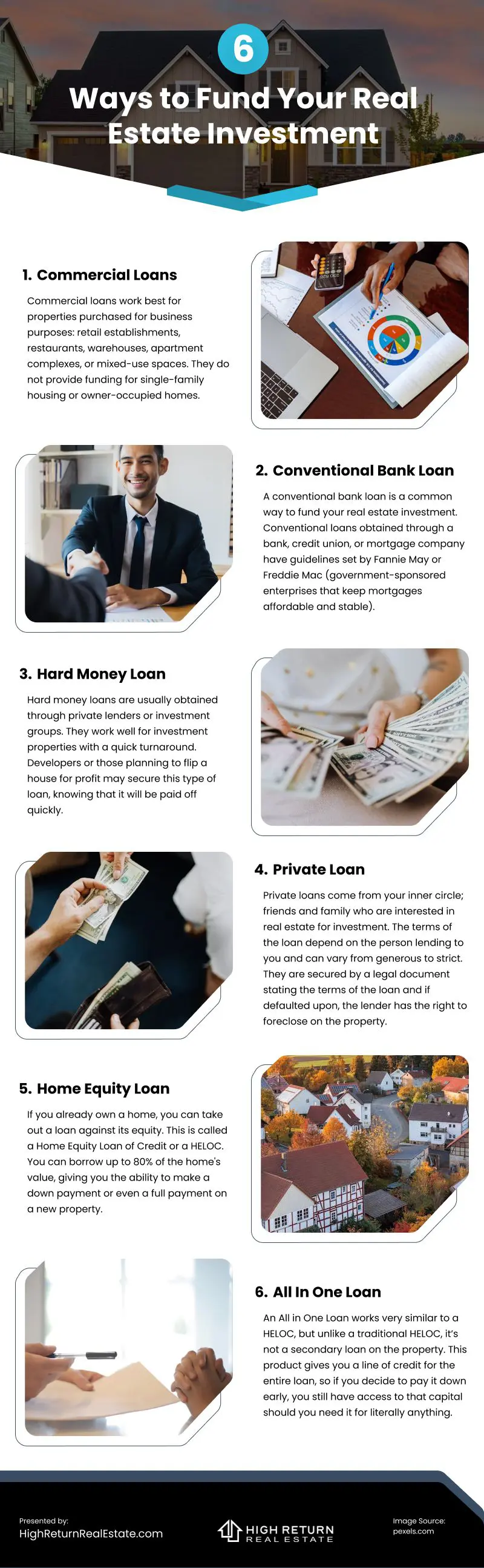

Infographic

Making an informed decision about lending options is essential for building a successful real estate investment portfolio. Discover in this infographic the five most common ways to finance property investments.