Building long-term wealth without getting buried in day-to-day stress is every real estate investor's goal. Turnkey investing is a smart step in the right direction. But when you pair that with multifamily properties, you're stepping into a whole new level of opportunity. Think steady income with fewer vacancies and streamlined operations, all without having to manage everything yourself.

It's the kind of setup that makes you see how turnkey multifamily rentals let you scale faster, earn more, and keep your time and sanity intact. Here are the top seven reasons why a multifamily home is a good investment and make sense as your next turnkey rental investment.

1. Instant Cash Flow

One of the biggest perks of investing in a multifamily turnkey property is that you start bringing in income from multiple units right away.

Most turnkey properties are already tenant-occupied and professionally managed, you can start collecting rent from day one. No waiting around for renovations or trying to find renters before your investment starts paying off. It takes the stress off your shoulders and gives you the kind of predictability every investor hopes for.

2. Reduced Vacancy Risk

With multifamily properties, you get a built-in safety net. Unlike a single-family home, where you get just one rent check each month, properties like duplexes, triplexes, or fourplexes give you several streams of cash all at once. You're not relying on just one tenant to cover all your costs. If one unit sits empty for a bit, you're still making money from the others.

Say you own a turnkey fourplex. If one tenant moves out, no big deal. You've still got three units bringing in income. That kind of built-in balance makes a huge difference, especially in areas where tenants tend to come and go.

3. Operational Efficiency Through Shared Costs

Managing multiple units under one roof just makes life easier and cheaper. Instead of paying separate bills for four different houses, you're sharing costs across one building. Need a plumber? They can knock out fixes in several units during one visit, which means fewer service call fees. Snow removal, landscaping; it's all done for the whole property, not duplicated at four different addresses.

And when you've got a turnkey provider handling all those details for you, the savings and efficiency start to add up. Over time, that kind of smart setup can make a big difference in your bottom line.

4. Scalability

If your goal is long-term passive income, scaling up your portfolio becomes a whole lot easier when you can add more rental doors with fewer headaches. Think about it. Buying four separate turnkey single-family homes means you're signing paperwork four times, coordinating four different closings, and juggling multiple property managers or maintenance schedules. That's a lot of moving parts to handle.

Now, imagine grabbing one turnkey fourplex instead. Just one transaction with one loan, and suddenly you have four rental streams coming in. It's like hitting the fast-forward button on your investing journey.

Turnkey multifamily rentals are one of the quickest ways to move from a notice investor to someone with a diversified portfolio. You deal with just one property management team and one set of expenses, but you reap the rewards of multiple units. It's a streamlined, efficient approach designed for growth.

5. Built-In Property Management Simplifies Ownership

The beauty of turnkey investing is that you're not stuck dealing with 2 a.m. plumbing emergencies or chasing down rent. When you buy a turnkey multifamily property, all of that is already handled for you. Property managers are in place, the tenants are vetted, rents are set to market rates, and systems are running smoothly for maintenance and rent collection.

Aside from the occasional update, your main job is to watch the rental income hit your account and keep track of your tax documents at the end of the year. You still own the property, but without the stress and time drain most people expect from being a landlord.

6. High Demand Among Renters

Multifamily properties attract a diversity of renters. People love the mix of affordability and that sense of community you often find in a well-run building. Plus, turnkey providers usually spruce properties up before listing them, so tenants walk into modern, move-in-ready units with nice finishes and updated amenities.

That kind of appeal means units get leased faster and tenants tend to stick around longer, which adds up to a stronger return on your investment and way less stress trying to fill vacancies.

7. Strong Return On Investment

When you invest in turnkey multifamily rentals in cash-flow-friendly cities like Indianapolis or Memphis, you're setting yourself up for stronger returns compared to high-cost markets where cash flow is harder to come by. These secondary markets offer better rent-to-value ratios and investor-friendly policies that work in your favor.

That's why Indianapolis investment properties have become such a hot pick, especially for buyers who want solid returns without the chaos of bigger markets. Many investors start with single-family homes, but once they run the numbers, they often pivot to multifamily. And with a turnkey structure already in place, it's easier than ever to skip the usual headaches and start seeing results faster.

Is a Turnkey Multifamily Property Right for You?

If you want steady, scalable income without getting bogged down in day-to-day hassles, turnkey multifamily is a smart move. You get more units and more cash flow, all wrapped up in one investment.

Whether you're just starting out or looking to grow your portfolio, this strategy makes building wealth simpler and more efficient. And with the right turnkey partner handling the details, you keep control while watching your income grow on autopilot.

Video

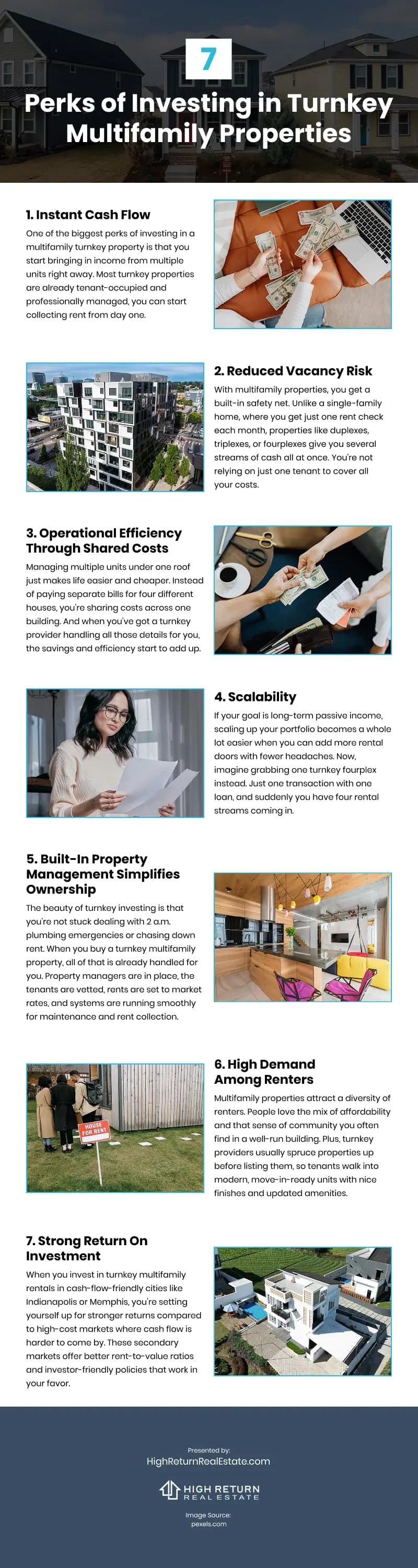

Infographic

Investing in turnkey multifamily properties is a top priority for real estate investors seeking to build long-term wealth while minimizing stress. Explore the benefits of investing in turnkey multifamily properties in this infographic.