Choosing to invest in real estate is a huge decision. It is a big investment that can lead to long-term wealth, financial growth, and personal fulfillment. But how do you know if you're ready to take the next step?

For many, the idea of owning property feels exciting and overwhelming. After all, it could be your ticket to growing and diversifying your wealth. But could the wrong investment turn into a drain on your finances, time, and sanity? You may never feel fully prepared to invest in real estate, but an experienced real estate investment company can help you feel confident taking a step forward and purchasing your first property.

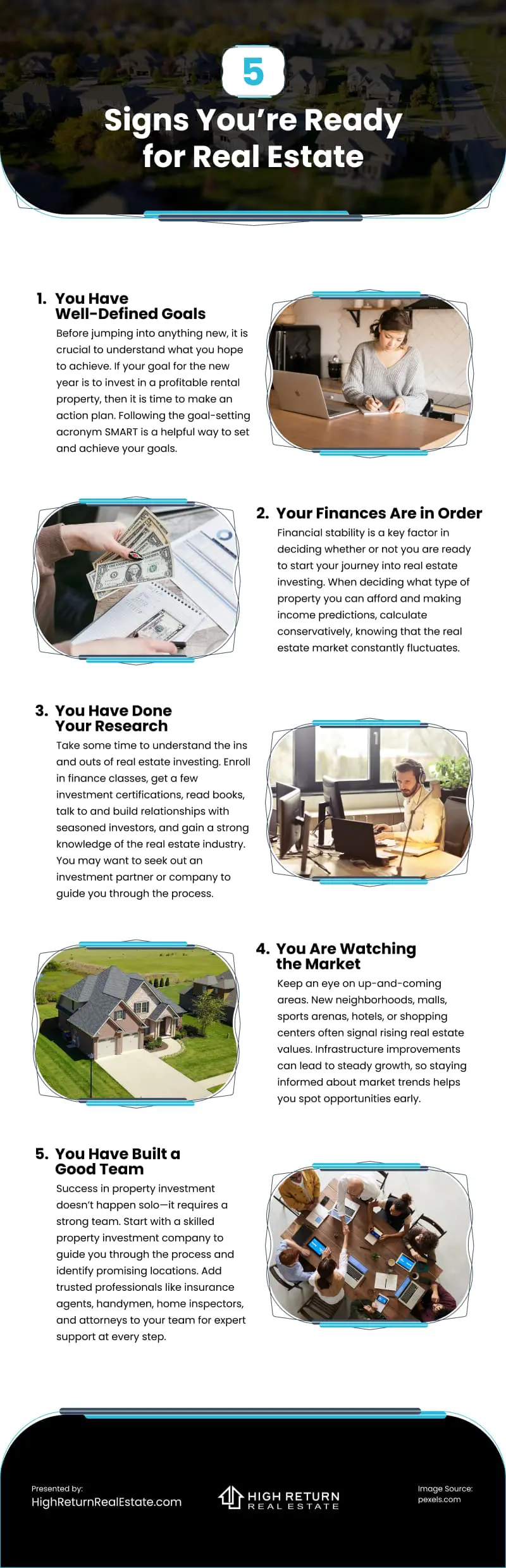

No matter the type of real estate ownership drawing you in, here are some sure signs that indicate you're prepared to take the leap.

1. You Have Well-Defined Goals

Before jumping into anything new, it is crucial to understand what you hope to achieve. If your goal for the new year is to invest in a profitable rental property, then it is time to make an action plan. Following the goal-setting acronym SMART is a helpful way to set and achieve your goals.

- S—Specific: Set goals that are clearly defined. Instead of saying you want to buy an investment property, set the goal of purchasing a property in a specific location within a certain timeframe.

- M—Measurable: Make a six-month, twelve-month, and five-year plan for your goals and evaluate your progress in each area. Your six-month goal could be to start researching investing; by twelve months, you want to have purchased a new property to rent; by five years, your goal could be to expand your portfolio and own multiple rental properties.

- A—Achievable: Set realistic goals within your capabilities, budget, etc. Lofty goals are fantastic, but smaller, more achievable goals will eventually get you there. Start small and work towards getting bigger.

- R—Relevant: Setting goals that align with your interests and motivations is crucial. If your goals are engaging and motivating, your desire to achieve them will stay strong.

- T—Time Bound: Creating deadlines for achieving your goals is a motivating factor. Knowing you want to purchase a property by the end of the year will keep you moving toward the outcome.

2. Your Finances Are in Order

How are your finances? Are you confident in where you are? Financial stability is a key factor in deciding whether or not you are ready to start your journey into real estate investing. When deciding what type of property you can afford and making income predictions, calculate conservatively, knowing that the real estate market constantly fluctuates.

Homeownership comes with the costs of property taxes, repairs, and upgrades. It is wise to have a fund set aside to cover these costs. The best investment advice is: Never invest money you cannot afford to lose.

3. You Have Done Your Research

Take some time to understand the ins and outs of real estate investing. Enroll in finance classes, get a few investment certifications, read books, talk to and build relationships with seasoned investors, and gain a strong knowledge of the real estate industry. You may want to seek out an investment partner or company to guide you through the process.

4. You Are Watching the Market

Pay attention to the areas that are up and coming. Are there any new neighborhoods in the works? Is there a new mall, sports arena, hotel, or shopping center planned? Those are all great places to look. Infrastructure improvements can mean steady increases in real estate values. Keeping your finger on the market's pulse will enable you to seize a great opportunity.

5. You Have Built a Good Team

You do not need to do this alone. Building a solid team is your key to success. Start by hiring a knowledgeable and experienced property investment company. They can help you through the process and make sure everything goes smoothly. They are also an excellent resource for finding up-and-coming locations that suit your needs. A good advisor is worth their weight in gold, but having a team of good insurance agents, handymen, home inspectors, and attorneys will also prove invaluable.

Is this your year to begin investing in real estate? It might be. Interest rate predictions indicate they may be lower than they have been over the past few years, and new tax incentives are emerging to encourage first-time investors. Additionally, there are so many exciting advancements in real estate technology, such as apps that assist with property management and other technologies that help empower investors with tools to make informed decisions.

The market demand for rental properties remains high as more people choose to work from home. Starting in January, you can make the most of these favorable conditions, build equity, and position yourself for long-term financial growth in a market with a forecast for growth.

Video

Infographic

Investing in real estate is a significant decision that can lead to long-term wealth and financial growth. How can you tell if you’re ready to take the plunge? Check out this infographic for clear signs that indicate you’re prepared for real estate ownership.